Summary: 1/ What is #DeFi? Components of DeFi

2/ What’s Yield Magnet?

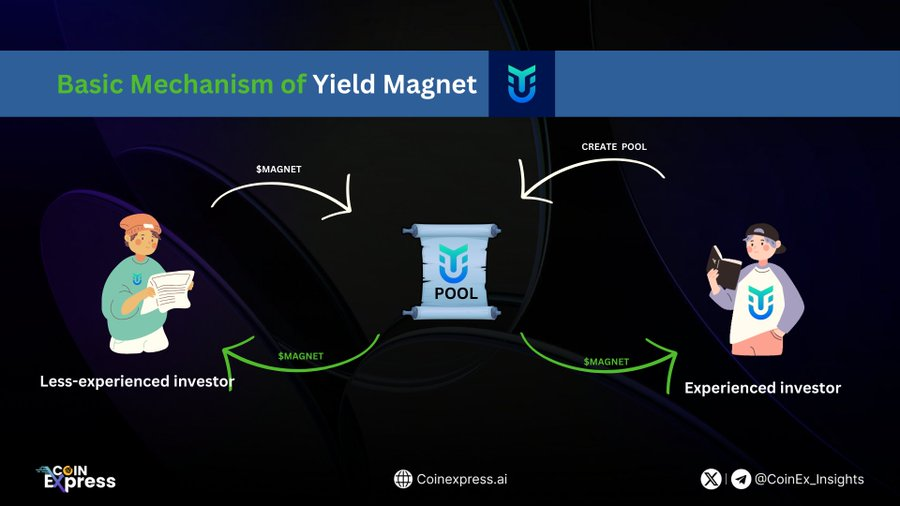

3/ Basic Mechanism of @YieldMagnet

4/ $MAGNET Tokenomic

5/ What Makes #Magnet Stand Out?

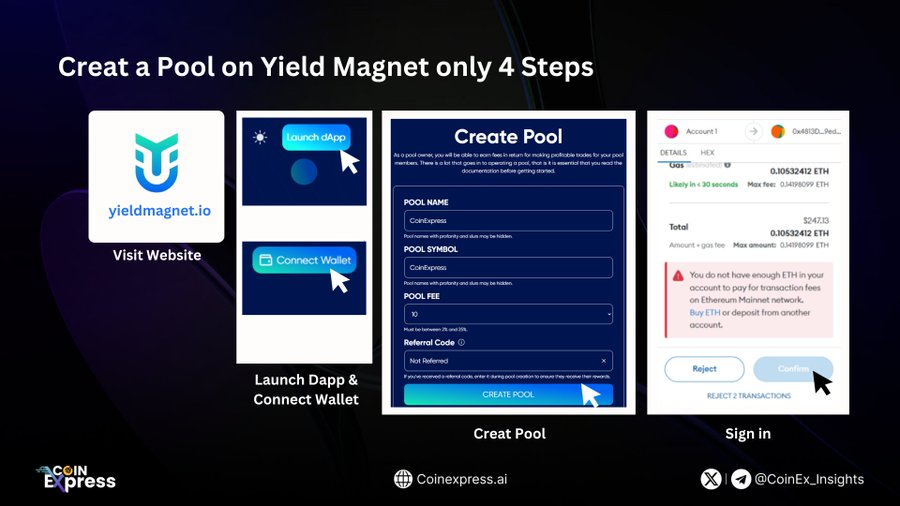

6/ How to Creat a Magnet Pool?

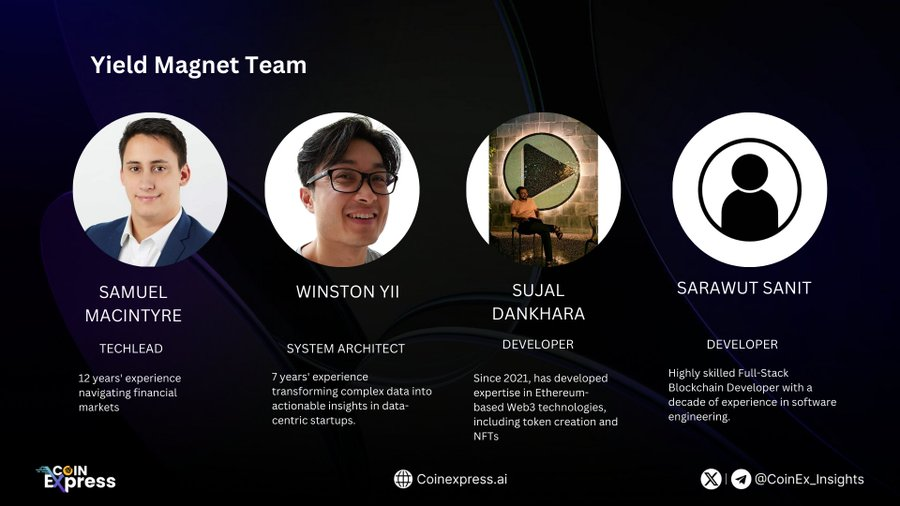

7/ Yield Magnet Team

8/ Roadmap

9/ Conclusion

#MagnetThread#CoinExpress#BTC#Bitcoin#CryptoCommunity

1. What is Defi? Components of Defi

DeFi, short for “Decentralized Finance,” is a subfield within #blockchain and #cryptocurrency that utilizes blockchain technology and smart contracts to provide traditional financial services without relying on intermediaries, banks, or centralized financial institutions.

The key components of DeFi include: #SmartContracts, #DEXs (include #Perp-dex), #Lending-Borrowing, #Yield Farming & #Staking, #Wallet, #NFT, #Oracle, #Bridge.

These components together create a new decentralized financial system, providing access to and control over finances for users without relying on traditional intermediary organizations.

2. What’s Yield Magnet?

Yield Magnet is a new DeFi platform that allows users to trade cryptocurrencies and generate income easily and efficiently – New Gen Yield Farming

3. Basic Machanism of Yield Magnet ?

Below are some specific examples of how Yield Magnet can be used:

- A beginner can use Magneties to create a diversified investment fund comprising various types of cryptocurrencies. Magneties will automatically manage this portfolio and optimize returns for the user.

- An experienced investor can use Magneties to create a fund focused on a specific area, such as #DeFi or the #metaverse. Magneties will help the investor easily track the fund’s performance and make necessary adjustmentAnyone can use the $MAGNET token for staking and earn passive income. The $MAGNET token will also be used in upcoming events of the Yield Magnet platform, such as airdrops and staking pools.

Anyone can use the $MAGNET token for staking and earn passive income. The $MAGNET token will also be used in upcoming events of the Yield Magnet platform, such as airdrops and staking pools.

4. Magnet Tokenomic

otal supply: 1 billion $MAGNET. Transaction Fee: For buying/selling $MAGNET, there is a 5% fee used as follows: 3% for marketing and development. 1% for liquidity. 1% for staking rewards. Staking: Receive 50% of platform fees and 20% of transaction fees from the upcoming V2 token. A primary asset for future features of Yield Magnet

The Tokenomics, while not yet fully allocated, operate in a way that all activities are geared towards community benefits, sharing revenue back with the community. This is commendable!

5. What makes Magent Stand Out ?

- Compared to other Yield projects, Magnet offers a superior operating mechanism, including the New Magnet Management Systems, Secure Magnets & High Voltage Magnets, New Fee Structure, Gas Refund System, and Stealth Magnets

- Allowing anyone to create a Pool and participate in Pools.

- The project’s operations share revenue back with the token-holding community

- The greatest benefit of managing a Yield Magnet Pool is the ability to maximize profitable trading and increase the value of the token pool. The visibility of the pool will increase with its value, attracting more deposits into the pool and enhancing liquidity. This, in turn, creates a positive feedback loop: the increase in pool value attracts users, leading to more capital inflow, and consequently, the continued growth in pool value.

In summary, managing a Yield Magnet Pool not only generates profits but also has a positive impact on the DeFi community, providing opportunities for participants and contributing to the sustainable development of the decentralized financial ecosystem

6. How to Creat a Magnet Pool

7. Yield Magnet Team

8. Roadmap

- Application Development Stream (dApp)

- New Product Development Stream

Both concepts will run in parallel and not be separated

9. Conclusion

The platform caters to both newcomers and experienced investors in the #DeFi market. Newcomers can benefit from simplified participation in professionally managed pools, offering passive income and potential token value growth. Experienced investors can apply their expertise, optimize profits, and expand their DeFi network by managing pools and creating tailored investment strategies.